If your financial obligation to earnings ratio is acceptable you can acquire numerous homes without issue. The debt to earnings ratio analyzes the amount of financial obligation that you have today and the quantity of income that you make. Each bank has its own limit for what it thinks about to be acceptable.

As long as you are below the debt to income ratio, the bank might more than happy to extend a home mortgage to include more residential or commercial properties. The concern is, how can you remain under the threshold?One alternative is to ensure that you do not live in any of the properties that you purchase under a mortgage.

As odd as it sounds, you might want to lease while you're constructing your home empire because it might almost double the loaning power you have. Another thing that can assist is to hilton timeshare las vegas have stable tenants. When you are looking for a blanket home loan, as these multi-property mortgages are called, the bank will need to know that you are managing the residential or commercial properties well.

Some individuals use a management company to take the inconvenience out of finding and handling renters. They will take a Look at more info portion of the lease, but it can be beneficial anyhow for the stability that they provide. Call Now or Submit our Pre-Approval FormIf you are seeking to get a blanket home mortgage, you ought to select the bank carefully.

Some of them are national banks, but it may be that dealing with an industrial loan provider would be a better choice. This is especially true if you don't tick all the boxes. For example, if you aren't able to make a huge downpayment or if your credit rating is good, however not excellent.

They also know the marketplace far better and are more likely to look favorably on a loan candidate just due to the fact that they are aiming to invest in your area. Consider speaking with a home loan broker, too. They have a large network of potential lending institutions to send you to and they might have the ability to advise one that you have actually neglected.

The Single Strategy To Use For How Much Negative Equity Will A Bank Finance

When the time pertains to invest in a 2nd home, go to the bank with info about the home and your business plan. Ask them to include that residential or commercial property to the home mortgage, and so on. Credit rating is essential for any loan. Remarkably, your individual credit score tends to be lesser for an industrial residential or commercial property than it is for a home because the company will take a look follow this link at the cash the structure is most likely to make instead of simply focusing on how you manage your money.

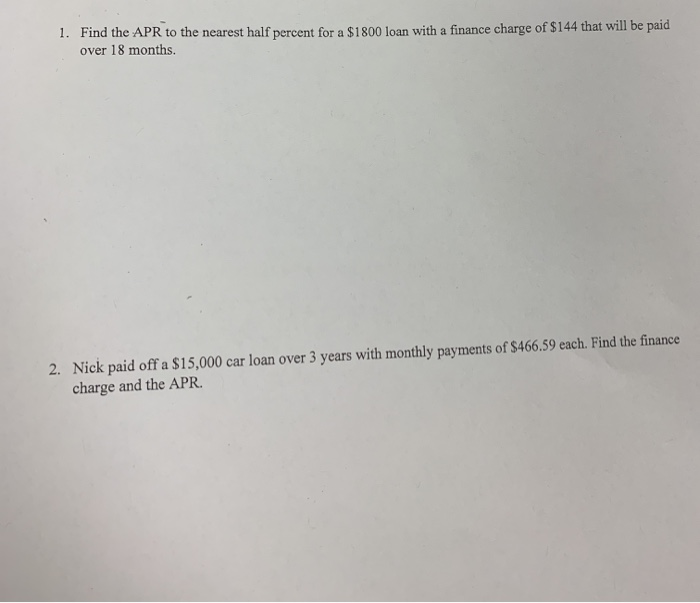

Depending on the fee, it may be a waste of cash to purchase points. Take a minute to exercise the overall expense of the loan at various rates of interest and with various payment schedules to exercise what would be the very best option in your situations. If your credit ranking is borderline, then make sure everything on it is proper.

Get rid of that financial association with an ex or an old flatmate. Inquiry that financial obligation you don't acknowledge. If you have defaults, see if you can get them gotten rid of if you work out with the lender. Or, if they're close to falling off your credit report wait a while to look for the home loan.

If you're new to investing, a multi-family property might be a good choice. This is due to the fact that multi-family residential or commercial properties tend to be less costly than a set of separate properties that would house the very same variety of households. You can get one mortgage, and you can let out the home to several people.

When you are all set to buy more properties, you can then start looking at either 'nicer' properties, wishing to handle higher quality occupants, or more multi-family homes in the exact same location to develop a portfolio of buildings that are simple to handle. Often you might wish to re-finance your business or rental home loan.

Make certain that you comprehend the terms that you are refinancing under and what rates of interest you will get, or be locking yourself into. An excellent financial organizer will be able to run the numbers and tell you just how much the loan will cost to pay back generally, and just how much it will cost if you start to repay early, in addition to how that compares to the home mortgage you have now.

The Ultimate Guide To Why Is Campaign Finance A Concern In The United States

There may be some circumstances where re-financing to protect your rate of interest for a specific variety of years could be a good choice. Refinancing is a gamble, nevertheless, and it is not something that you must do gently. Do not fall into the trap of going after the short term cash injection if the expense is going to paralyze you over the next years.

Keeping various properties with different lending institutions, and even under various minimal liability companies, can use you some protection must things go wrong. Make certain that you are clear on the level of risk, which you do not handle more properties than you can pay for to handle. Be prepared to offer homes that are not working out, and communicate with the bank routinely, particularly if something isn't going as planned with a financial investment.

Those very first couple of residential or commercial properties are the hardest for many people to get, once you have them it's possible to broaden your rental empire progressively every year.

Passive investing has actually become synonymous with today's biggest retirement automobiles. Couple of exit methods can build wealth on the exact same level as a properly assembled rental property portfolio (how do most states finance their capital budget). It is likewise worth keeping in mind that the benefits of passive income investing can compound significantly with each additional residential or commercial property added to a particular portfolio.

Therein lies the real advantage of buying numerous rental residential or commercial properties: investors may profit from the benefit from a number of possessions without putting in anymore of their own time or effort. That stated, purchasing a single property isn't the like understanding how to purchase several rental residential or commercial properties. While there are certainly resemblances, financiers who want to develop a portfolio requirement to know how to best scale their efforts. what is a finance charge on a loan.

However, much like every other business undertaking, the process can be made simpler if it's broken down into specific steps. In an effort to simplify the process of purchasing multiple investment residential or commercial properties, here's a detailed guide to utilize as a recommendation for developing your own portfolio: Define The Endgame: The very first thing investors need to do prior to they purchase their very first rental property is to plainly and definitively specify their goals.

Not known Factual Statements About Which Of The Following Can Be Described As Involving Direct Finance?

Therefore, you require to specify your objectives in order to develop strategy. Leverage Somebody Else's Money: The ability to buy realty with somebody else's cash, whether it's a bank or private loan provider, is among the biggest advantages of realty investing. In protecting funds from another celebration, investors are not only able to purchase sooner instead of later, however they are likewise able to prevent completely tapping their own reserves.